green card exit tax calculator

You can use GC calculator to estimate when your priority date may become current. Since USCIS updates data every few weeks estimated date shown below may also change every few weeks.

The New Form 8854 Reporting Requirements Explained 2022

For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15.

. This is known as the green card test. USCIS Case Processing Time. Enter case receipt number.

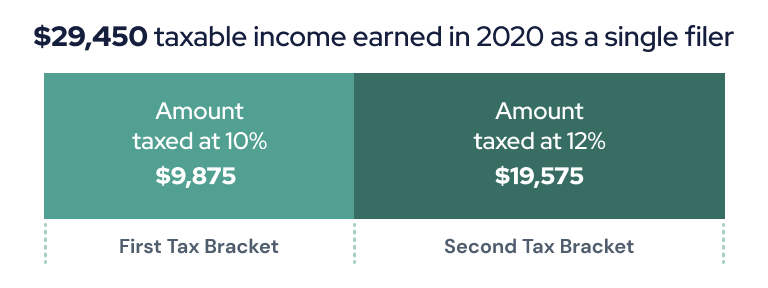

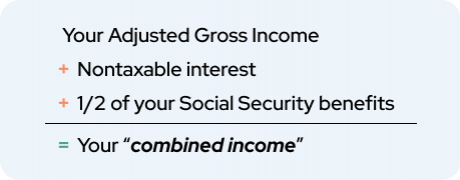

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. Our USImmigration Calculator provides you with various categories of immigration data and statistics. For married taxpayers each spouses net worth is calculated separately from the other.

We have several calculators and tools so you can get the latest updates and. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854.

The mark-to-market tax does not apply to the following. In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US. If they own their.

For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. With the ever-increasing IRS enforcement of offshore accounts compliance and foreign income reporting the number of.

It is not just your US. Exit tax applies to. Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return.

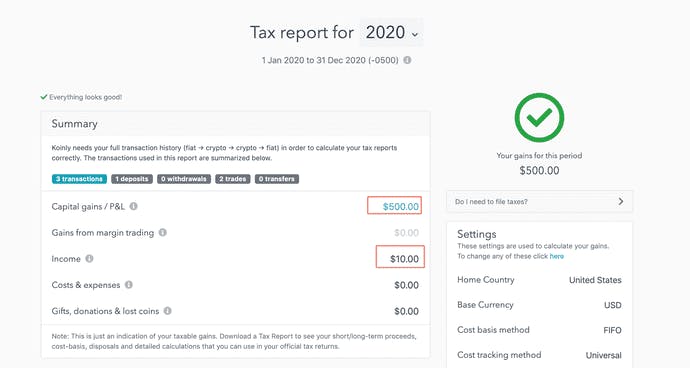

The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. And if you trip any of these tests you should calculate the exit tax. Exit tax is calculated using the form 8854 which is the expatriation.

This is the aggregate net value of worldwide assets. Green Card holders who have lived lawfully in the US for eight out of the last fifteen years may be subject to the exit tax regardless of their income net worth or filing. Green Card Exit Tax Calculator.

You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration. Citizens who have renounced their. The Form 8854 is required for US citizens as part of the filings to.

To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. Exit Tax for Green Card Holders. Discover Helpful Information And Resources On Taxes From AARP.

Long-Term Resident for Expatriation. Green Card Exit Tax Abandonment After 8 Years.

The New Form 8854 Reporting Requirements Explained 2022

What Is Form 8854 The Initial And Annual Expatriation Statement

What Is Form 8854 The Initial And Annual Expatriation Statement

What Is Form 8854 The Initial And Annual Expatriation Statement

Exit Tax For Long Term Permanent Residents Blick Rothenberg

What Is Form 8854 The Initial And Annual Expatriation Statement

Leaving Tcs Onsite Skill Letter For Green Card Usa

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Florida Seller Closing Cost Calculator 2022 Data

Free Tax Preparation For Seniors A Guide Of Resources

What Is Form 8854 The Initial And Annual Expatriation Statement

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Exit Tax For Long Term Permanent Residents Blick Rothenberg

Free Tax Preparation For Seniors A Guide Of Resources

What Is Form 8854 The Initial And Annual Expatriation Statement

France Cryptocurrency Tax Guide 2021 Koinly

France Cryptocurrency Tax Guide 2021 Koinly

Five Things To Know Before Renouncing Us Citizenship Because Of Expat Taxes